Expertise:

Intermediate

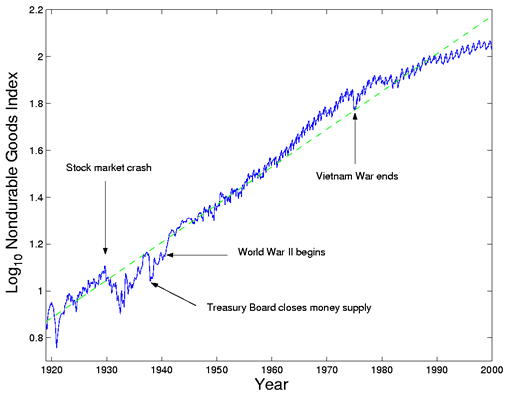

Should we transform the index?

Like most economic indicators, the nondurable goods index tends to exhibit

exponential increase, corresponding to percentage increases over fixed time periods.

Moreover, the index tends to increase in size and volatility at the same

time, so that the large relative effects surrounding the Second World War seem

to be small relative to the large changes in the 1970s and 1980s, and seasonal

variation in recent years dwarfs that in early years.

We prefer, therefore, to study the logarithm of this index, displayed in Figure

2. The log index has an overall linear trend with a slope of 0.016, corresponding

to an annual rate of increase of 1.6%, and the sizes of the seasonal cycles are also

more comparable across time. We now see that the changes in the depression

and war periods are much more substantial and abrupt than those in recent

times. The growth rate is especially high from 1960 to 1975, when the baby

boom was in the years of peak consumption; but in subsequent years seems to

be substantially lower, perhaps because middle-aged "boomers" consume less,

or possibly because the nature of the index itself has changed.

Figure 2: The monthly nondurable goods production shown in Figure 1 plotted

on a logarithmic scale.

The dotted straight line is estimated by least squares

regression, and has a slope of 0.016,

corresponding to a 1.6% increase in the index per year.

How will functional data analysis help?

There is a vast library of methods for analyzing long time series, and they

seemingly would be the first choice in this situation, too. However, notions like

ARIMA processes, frequency domain time series analysis and the Kalman filter

are based on the idea of stationarity, the idea that the internal structure of

the series remains unchanged over the span of observations. The goods index,

however, is clearly nonstationary in many ways. There are important departures

from linearity, and the seasonal trend, as we shall see, also changes dramatically

from one epoch to another. Moreover, the series is intrinsically rather smooth;

a huge economy like that of the U. S. A. does not change its behavior suddenly.

We can exploit that smoothness by looking at derivative information.

The data consist of 973 monthly values of the index covering the period from

January, 1919, to December, 2000, and can be obtained from the

FDA software site.

|